Your Attractive Heading

Parents

If you have a child planning to attend college, you have a role in completing the FAFSA.

Filing the FAFSA is the first step in financial aid to pay for college. For most students, completing the FAFSA requires information from a parent. Filing the FAFSA does not mean you have to provide financial support for your child in college, but information from at least one parent is required for your child to complete the FAFSA and qualify for financial aid, including the Pell Grant, Access Missouri, and the A+ Program.

Who needs to complete parent information on the FAFSA?

The purpose of the FAFSA is to determine household income that can be used to pay for college. For dependent students, the FAFSA requires financial information from at least one biological or adoptive parent. Most students under the age of 24 are considered dependent. Legal guardians or other relatives should not complete the parental information section of the FAFSA.

In cases of separation or divorce, the parent who provides the most financial support is required to provide financial information. When completing the FAFSA, you will see a Parent Wizard that will help determine you who is considered a parent for each student applicant. This tool from Federal Student Aid can help you decide who should contribute information to the FAFSA.

Parents without a social security number will need to contribute information to the FAFSA. They will need a FSA ID and can apply for one here. When applying, click the box that says “I don’t have a social security number.” This will take you to the process for creating an FSA ID without a social security number. Parent information is kept secure, and only used for determining the student’s eligibility for financial aid. This blog from the National College Attainment Network has more information. Click here for instructions in Spanish on how to apply for an FSAID without a Social Security Number. This page has resources for mixed status families.

Curious about what aid your student may be eligible for? Use the Federal Student Aid Estimator to receive an estimated Student Aid Index and Pell eligibility information.

What parents need to do

Step 1: Create a FSA ID

You will need to create a Federal Student Aid ID separate from your child’s, using your own phone number and email address to verify the account. Your FSA ID is the username and password you will use to access all Federal Student Aid websites, including StudentAid.gov which is home to the FAFSA form. Before you can start your FAFSA, you must have an FSA ID. If you previously set up a FSA ID, you do not need to create a new one.

For more information about creating an FSA ID, see this resource from The Scholarship Foundation of St. Louis or visit this page from Federal Student Aid.

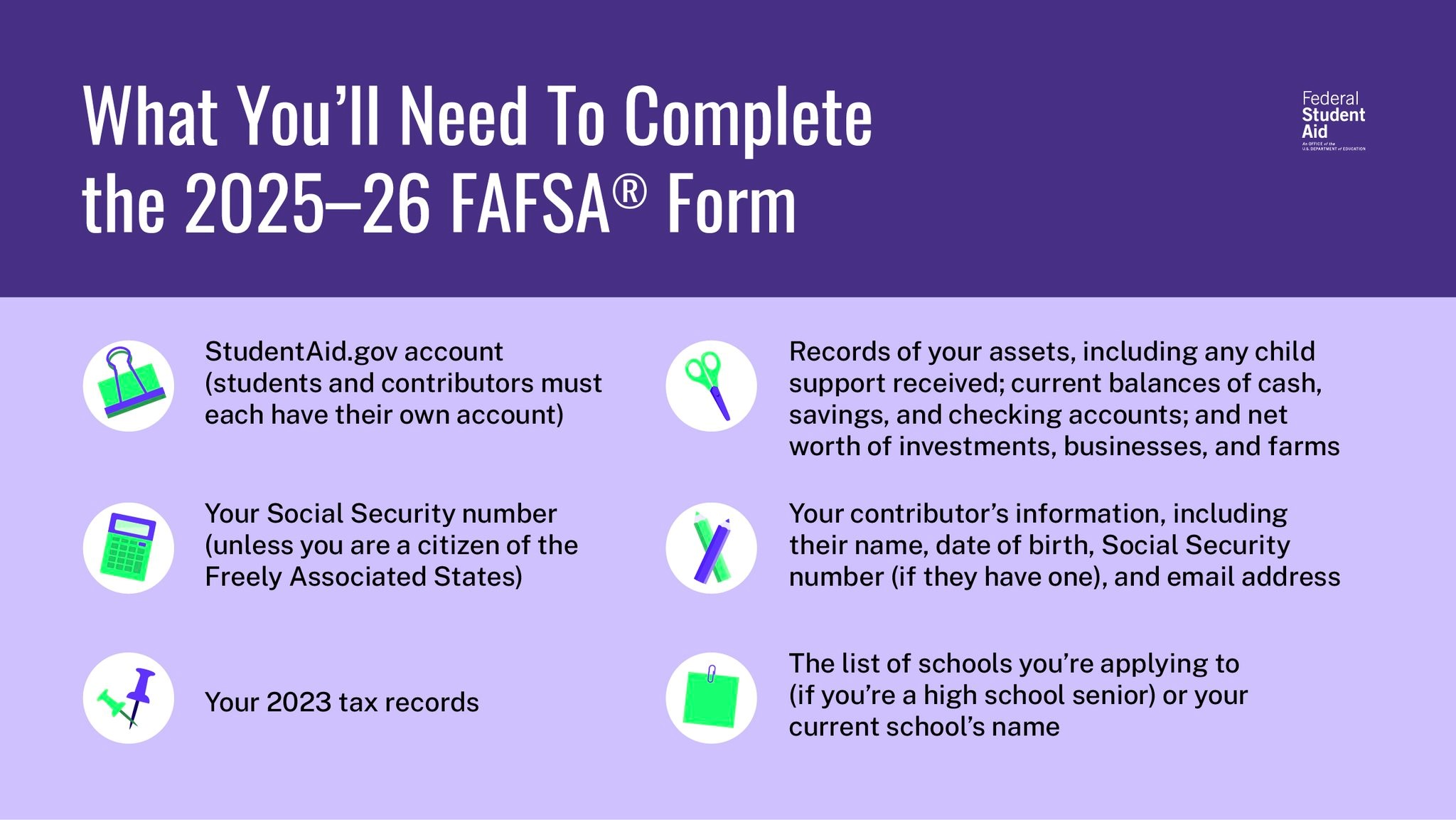

Step 2: Gather your information

Before completing your FAFSA, make sure you have the following information available. The same information is needed for the 2026-2027 FAFSA, but you will need your 2024 tax information.

Step 3: Complete the FAFSA

Your child will start the FAFSA using their own FSA ID, and will invite you as a contributor to enter your financial information. You will receive an email from Federal Student Aid with a link to log in. Your student will also receive a code you can use to log in and contribute to their form.

Each school and state program has different priority deadlines. While it won’t make your student ineligible if they miss a priority deadline, the funding in many programs is offered on a first-come, first-served basis, so make sure you file early.

Click here to start your FAFSA

Check out these tips and tricks from FSA and MOCAN if you are having trouble completing the FAFSA.

Step 4: Review your FAFSA application

Review your FAFSA for accuracy and make any corrections necessary before you hit submit. For the FAFSA to be fully submitted, both the student and parent need to complete and sign their sections. Whoever completes last can submit the FAFSA. You should receive a confirmation email from Federal Student Aid. If not, log back in to make sure everything is completed.

Step 5: After you file

Your child can expect to receive a report called the FAFSA Submission Summary (FSS) with their Student Aid Index (SAI) a few days after submitting their FAFSA. The FSS tells you what federal aid your child can expect to receive and what they are expected to pay towards their education. This will not include state aid, institutional grants, or private scholarships.

If you notice an asterisk (*) next to the SAI on the FAFSA confirmation email or FAFSA Submission Summary, it means the FAFSA has been flagged for verification and the college may ask for additional documentation. Have your student check their email and college communication portal for updates.